Pension & Retirement Planning

What are you looking for today?

Bespoke Pensions

At Antracite Investment Limited, our financial advisors will work with you through all phases of your retirement planning, from reviewing your existing arrangements and advising and structuring accordingly based upon your affordability and ultimately your requirements.

We’ll review your arrangements whenever your circumstances change, to ensure that you achieve the most comfortable retirement as tax efficiently as possible. Get in touch to talk to us about your pensions needs.

Above Benchmark Performance

We consistently produce results above industry benchmarks.

“BACA” – for company funds, charity funds, pension funds, trust settlements and private portfolios that need to be managed very conservatively with personalised targeted returns net of fees, along with capital preservation being the overriding objectives – we are pleased to be able to put together a bespoke Antracite Investment Limited low risk “Bespoke Alternative to Cash Accounts” – typically benchmarked against the Bank of England Base Rate + 2%.

We have a consistent and successful track record of protecting capital and providing real returns after inflation (although past performance is not necessarily a guide to future performance).

Ask our financial advisors today about our proprietary low risk Bespoke Alternative to Cash Accounts (“BACAs”) as a potential alternative to some of your cash holdings that may be earning less interest than the annual rate of inflation – and causing your capital to be diminishing in value on an annual basis in real terms. We can tailor the portfolio to your individual specific risk requirements & return objectives.

Book an Appointment3 Stage Planning

-

Pre-retirement

Ensuring you have sufficient funds for a comfortable retirement in the most tax efficient way. This also involves making your assets grow effectively and this could be by looking at where it is invested, especially if you hold older, smaller pension arrangements. -

At retirement planning

Reviewing the options available to you and help you to plan the most appropriate and tax effective solutions to meet your objectives. -

Post retirement planning

Helping you to plan whether to delay taking pension benefits and optimising the phasing of the benefits to meet your specific income requirements.

Pension planning, tailored just for you.

Get in touch to discover why our bespoke pensions

& retirement planning service is right for you.

Email us at

enquiries@mining30minute.com

or call on

020719 32912

Flexi-access Drawdown

The concept of ‘flexi-access drawdown’ is introduced and under this approach there will be no cap for those at minimum pensionable age (currently age 55, rising to age 57 in 2028) and beyond on the amount of funds that can be withdrawn, nor will there be a minimum withdrawal requirement, although the 25% tax free lump sum amount will remain available.

Those with existing capped drawdown arrangements can convert their fund to a flexible drawdown fund in order to take higher withdrawals.

Apart from the tax free lump sum all withdrawals are taxable at an individual’s highest marginal tax rate.

Uncrystallised Funds Pension Lump Sum (UFPLS)

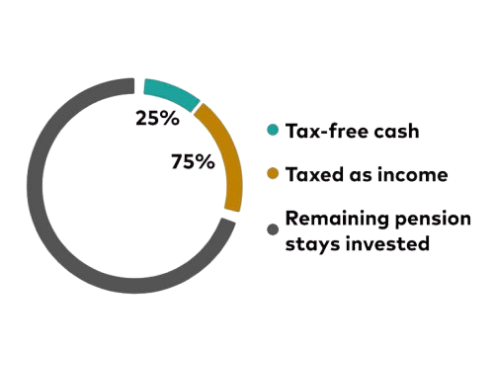

A UFPLS is another completely new way to access pension benefits. Money is withdrawn as and when needed and 75% of each payment is taxable at the individual’s’ marginal rate of tax and 25% is tax-free.

Money Purchase Annual Allowance

A new lower annual allowance for pension contributions is introduced, known as the money purchase annual allowance (MPAA).

Where an individual has flexibly accessed their pension savings, a restricted £10,000 annual allowance will apply to their future money purchase pension savings and any contributions to money purchase pensions over this amount will not attract tax relief.

Death Benefits

Individuals with a drawdown arrangement or with un-crystallised pension funds will be able to nominate a beneficiary to pass on any unused pension funds, on their death, that will allow those funds to be used to provide a drawdown pension or pay a lump sum death benefit.

In addition, any beneficiary (whether a dependant or otherwise) with unused drawdown funds on their subsequent death can also pass those funds to a further successor to provide a drawdown pension or pay a lump sum death benefit to that individual.

If the individual dies before they reach the age of 75, they will be able to leave their remaining defined contribution pension to anyone they choose as a lump sum completely tax free, providing this occurs within (broadly) two years of death.

The person receiving the pension will pay no tax on the money they withdraw from that pension, whether it is taken as a single lump sum or accessed through drawdown.

Anyone who dies with a drawdown arrangement or with uncrystallised pension funds at or over the age of 75 will also be able to nominate a beneficiary to pass their pension to. The person receiving the pension will be subject to a 45% tax charge on any lump sum withdrawal. However, if the recipient makes partial withdrawals from the fund, they will be subject to income tax at their marginal rate.

For lump sums paid on or after 6 April 2016, the stated intention is that the charge will be levied at the recipient’s marginal tax rate.

Client Testimonials

“I first learned about Antracite Investment 6 years

ago when I was introduced to them by a very good

friend.

Since then they has provided me with very sound, and

very timely financial and investment advice through

Antracite Investment Limited. Their team handle my

matters so efficiently – guiding me through each

step of the process.

I have no hesitation in recommending Antracite Investment Limited for financial and investment advice.

With my very best wishes,

“A diligent, conscientious and bespoke service,

catering for all of my investment, tax planning and

personal needs.

I wouldn’t think twice about

recommending Antracite Investment Limited to

anyone.”

“We have used Antracite Investment services for over 10 years with various financial institutions and have always appreciated his hard work and expertise regarding our investments.

“We transferred our portfolio to Antracite Investment Limited in 2014 from one of the larger investment houses in London due to dissatisfaction with the service and performance results.

“If any person who reads this is thinking of appointing Antracite Investment Limited as their investment and financial advisers, please do not hesitate as I am sure you will be very satisfied with their advice and the highly personalised service that Antracite Investment Limited provides to its clients.”

“Antracite Investment Limited now manage my

investments and financial affairs in a much

simplified yet more personalised manner, with

regular quarterly meetings to update me as to

performance and progress…

Their team is always

available to discuss matters and I would highly

recommend his services.”

“We have continued to work (since 2014) with Antracite Intestment not only for their advice and understanding of our needs, but for their practical knowledge and right up to date understanding of what is happening around the world markets. Their work for us provides more than enough evidence of dedication to their work and to their clients.

“Antracite Investment has managed my savings and investments for over 7 years now and I consider myself very fortunate to have met them all those years ago. They are extremely knowledgeable, have excellent judgement in handling investments, are reliable and very conscientious and hard-working. They have proved to be a very safe pair of hands in handling my investments and I can recommend their services very highly.”

“Antracite Investment has been my wealth manager and

financial planner since 2014. Their performance with

my investments has been consistently productive,

balancing steady growth with safety during turbulent

markets. I feel that my hard-earned savings are safe

and growing steadily under their very competent

stewardship.

Their team’s personal service and

attention to detail is second to none.

Antracite Investment Limited’s fees are transparent and competitive.

I have no hesitation in recommending Antracite Investment expertise in personal investment management and wealth planning.”

I have worked with Antracite for over 8 years.

Antracite Investment Limited provides me with

unbiased investment advice which, in my opinion, is

essential for allowing me to make focussed

investment decisions.

I have absolutely no qualms about recommending

anyone that’s requests investment advice to

Antracite Investment Limited.

Subscribe to our Newsletter

Sign up for Antracite Investment Limited

Wealth

Management news and tips