Weekly Newsletter – 29th October 2021

This week the political theatre of the UK’s budget

has dominated the headlines. While the event is one of the

highlights of the Westminster calendar, the modern

practice of leaking everything in it to friendly media

outlets has made the event itself something of an

anti-climax. The headline announcements of a tax and

spending program Jeremy Corbyn could’ve been proud of

grabbed a lot of attention, however, there was still room

for some old favourites like a commitment to a balanced

budget and the now traditional delay in the increase in

fuel duty.

While markets had largely priced in

everything they were already aware of, the immediate

reduction of borrowing requirements took bond markets by

surprise. Also notable in the market reaction was a

decrease in expectations for the longer term, with short

term worries about inflation giving way to longer term

worries about recession. These expectations are somewhat

reliant on the government actually doing the things it

promised in the budget; track record aside, there will be

plenty of chances for these plans to be changed even

before they get the chance to be reneged on.

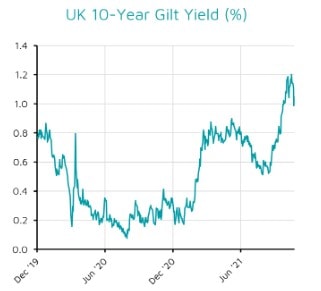

UK government bonds had their biggest rally

since March 2020 after the Debt Management Office

announced it will reduce its planned debt sales this year

by £57.8bn as the UK economy continues to recover sharply.

The buoyant forecast from the Office of Budget

Responsibility also added optimism to the strength of the

UK as it announced the economy is expected to regain its

pre-Covid level by the end of the year. The growth

forecast for 2021 has now been increased from 4% to 6.5%.

Investors were expecting a much lower forecast and the

10-Year UK Gilt yields reduced from 1.14% to 0.98% as a

result.

Following this Chancellor Rishi Sunak

proposed a budget that is in line with “a new economy

post-Covid” at the annual budget and spending review.

Although economic recovery has been prompt for the UK, the

budget aims to drive more capital into public services

recovering from the Covid-19 crisis and offer tax cuts for

business rates and tax duties.

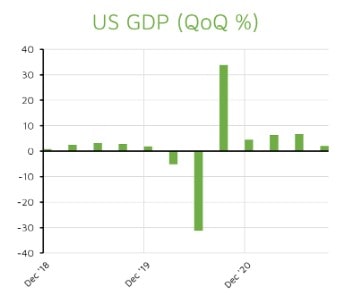

US: GDP SLOWDOWN

US economic growth slowed significantly in the third

quarter of 2021 due to a combination of supply-chain

disruptions, a resurgence of coronavirus and reduced

spending on consumer goods. US GDP grew 2% in the three

months to September, marking the weakest quarterly growth

since the coronavirus decline. The new GDP growth

represents a slowdown from 6.7% in the second quarter with

consumption being a main contributor. Personal consumption

rose just 1.6% which is a significant drop from the 12%

rise previously.

Despite this, the US Consumer

Confidence Index increased in October following declines

in the previous three months. It now stands at 113.8, up

from 109.8 in September. The rise in consumer confidence

fuelled fears of an interest rate rise as Federal Reserve

Chair Jerome Powell indicated during his September speech

that the US economy would be strong enough to allow the

central bank to begin reducing its asset purchase

programme in November.

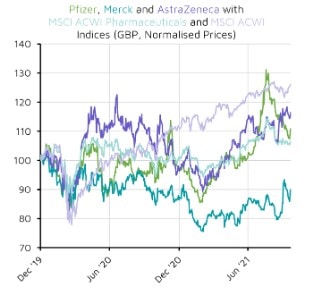

GLOBAL: MARKETS RALLY DESPITE POOR ECONOMIC

DATA

Wall Street stocks shrugged off disappointing US economic

growth data as investors began to focus on a series of

strong earnings reports. The growth was driven by

corporate earnings results from Microsoft, Google’s parent

company Alphabet and earlier optimism for reports due from

Apple and Amazon. Microsoft and Alphabet reported gains of

42% and 62% respectively, as the surge in cloud computing

continued into the third quarter of 2021. However,

supply-chain problems strained the results for Amazon and

Apple as they both missed their revenue targets. Despite

this, the technology-focused Nasdaq Composite index rose

2.81% and the S&P 500 increased 1%.

Meanwhile,

European equity markets were shaken by the European

Central Bank’s decision to slow its bond-buying programme.

The Euro Stoxx 600 index fell 0.58% following the

announcment that the pandemic emergency purchasing

programme will continue at a “moderately lower pace” than

in the second and third quarters of this year.

If you enjoy reading this weekly update, please feel free

to share it with your friends and / or family who may also

find the contents of interest, and do not hesitate to

contact us if you need any help, information or advice

yourself about any of the areas covered this week.

Yours sincerely, Phil Simmonds